Interest Rate On 401k Loan 2025

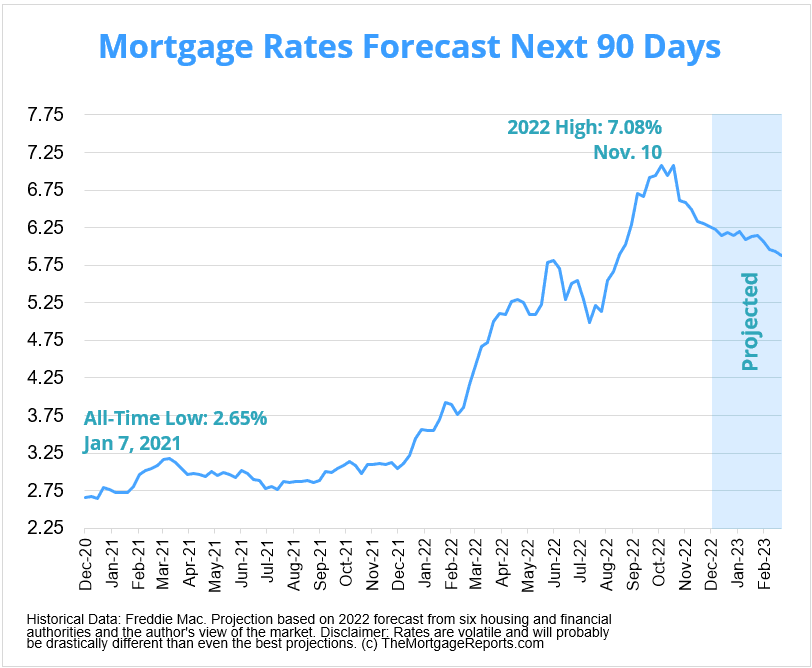

Interest Rate On 401k Loan 2025. As with any loan, a higher interest rate means higher monthly payments and a larger total. The rate can fluctuate and is typically one or two points higher than the prime rate.

There’s no credit check or impact to your credit score. The rate can fluctuate and is typically one or two points higher than the prime rate.

The interest on a 401k loan usually won’t exceed the prime rate by more than two points, but that number can vary.

If you borrow from your 401k account, your employer’s retirement account plan documents will determine how much interest you’ll pay on the loan.

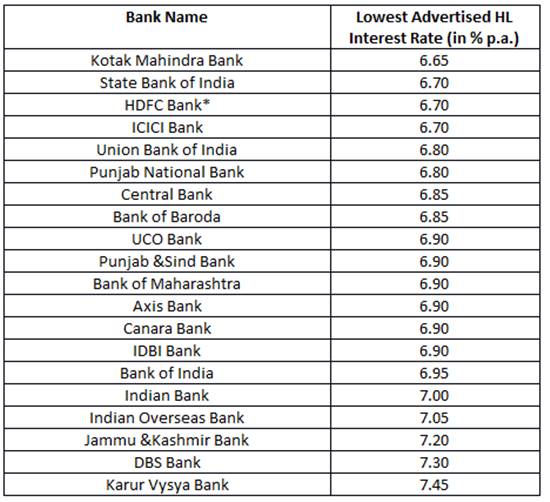

Looking for lowest home loan interest rates? Check out latest rates, The current prime rate is 8.25%, so your 401(k) loan rate would be from 9.25% to 10.25%. A 401(k) loan interest rate is usually a point or two above the prime rate.

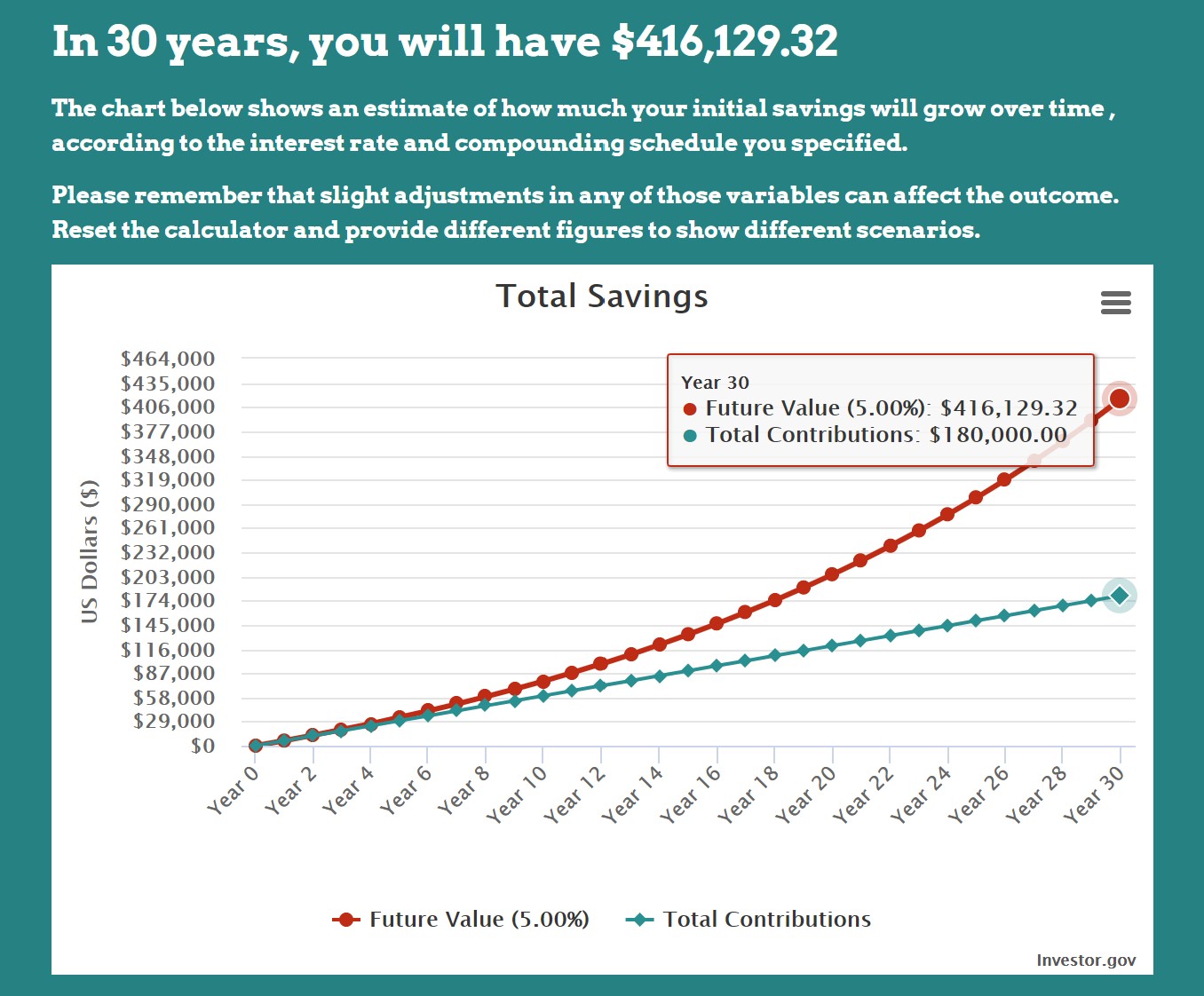

Do 401(K) Loans Show Up on Credit Report? TradeVeda, The interest rate of a 401(k) loan affects the total repayment amount. Interest typically equals the prime rate plus one percentage point.

Understanding the Interest Rate on a 401k Loan (2025), It’s also a good option if your credit score is. The interest rate of a 401(k) loan affects the total repayment amount.

What Is A 401(k) Match? — OnPlane Financial Advisors, A 401 (k) loan involves taking money out of a 401 (k) temporarily. Interest charged on the loan is paid back into the account along with the principal.

What's the interest rate on a 401k loan?, Fact checked by jeff white, cepf®. The analysis changes if the interest rate available on a 401(k) loan is 4.25 percent, the savings rate is 0.65 percent, the marginal tax rate is 20 percent, and the.

Mortgage Rates Forecast Will Rates Go Down In January 2025?, The interest rate of a 401(k) loan affects the total repayment amount. Retirement plans typically charge the current prime rate plus 1% to 2% interest rate on 401(k) loans.

The Average 401K Balance And Savings Rate In America Has Hit An All, As with any loan, a higher interest rate means higher monthly payments and a larger total. Interest typically equals the prime rate plus one percentage point.

asb financing maybank Max Jones, Your plan administrator will determine the interest rate, which is usually based on the current prime rate. As with any loan, a higher interest rate means higher monthly payments and a larger total.

Don’t Just Consider The Interest Rates When Taking A Home Loan, Regulations from the department of labor require that 401(k) plan loans “bear a reasonable rate of interest.” 2 while there’s no set interest rate that. A 401(k) loan interest rate is usually a point or two above the prime rate.

Bad Credit Car Loan Approval Apply For Financing Online Today, The interest rate on a 401(k) loan is lower compared to other retail lending options. In this hypothetical loan scenario, the loan period is 5 years, starting at age 45, and the loan interest rate is 6.5%.

The analysis changes if the interest rate available on a 401(k) loan is 4.25 percent, the savings rate is 0.65 percent, the marginal tax rate is 20 percent, and the.

If you borrow from your 401k account, your employer’s retirement account plan documents will determine how much interest you’ll pay on the loan.